Folks are getting snatched up left and right by the feds for PPP schemes! This time, several business owners in Georgia & South Carolina conspired an elaborate scheme to get those PPP coins. It didn’t work though. More inside…

When the government announced it would be dropping millions to help small businesses stay afloat during the COVID-19 pandemic, scammers got to scamming!

A group of business owners in Georgia and South Carolina conspired to get a first-class flight to “where the money resides.” The group is now facing conspiracy and money laundering charges after allegedly falsifying documents to secure Paycheck Protection Program (PPP) loans.

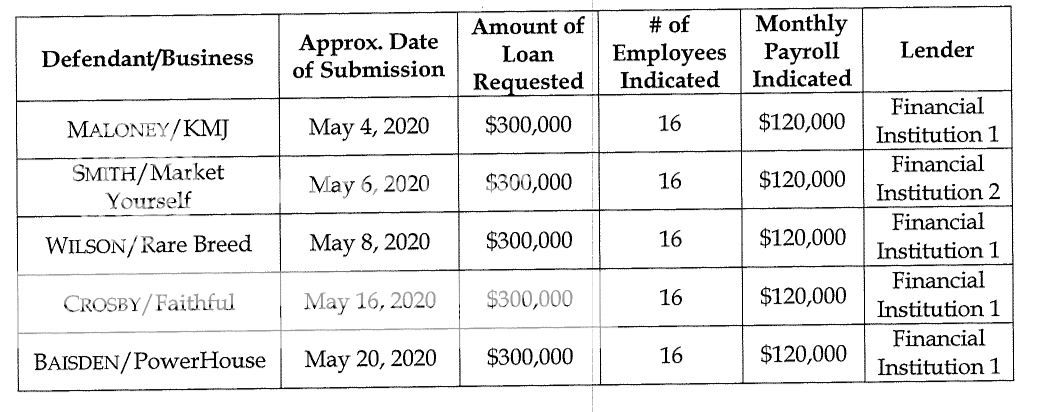

Georgia residents Rodericque Jarmaine Thompson, Micah Baisden (PowerHouse Sports Academy LLC in Doraville), Tabronx Smith (Market Yourself LLC in Norcross) and Thomas Wilson (Rare Breed Nation LLC in Atlanta), along with South Carolina residents Travis Crosby and Keith Maloney Jr., were named as defendants in the case by acting U.S. Attorney Bobby Christine. Antonio Hosey, who is also a Georgia resident, was also named as a co-conspirator.

According to a court filing with the U.S. District Court for the Northern District of Georgia Atlanta Division, Rodericque Thompson was the ringleader who recruited Micah, Travis, Keith, Thomas and Tabronx to apply for PPP loans that they weren't eligible to receive.

Here’s how they did it…

The business owners signed and submitted PPP applications that Rodericque partially completed. Turns out, the information he filled in contained fraudulent tax forms and other documentation. The documents showed each company paid 16 employees $358,819 in quarterly wages, tips and other compensation, according to the filing.

They used the falsified documents to request a cool $300,000 in PPP funding for EACH company. Cross River Bank (Fort Lee, N.J.) and Celtic Bank Group (Salt Lake City, Utah) disbursed the loans into the business owners’ checking accounts.

Since Rodericque was the ringleader of the elaborate scheme, he had Michah, Travis, Keith, Thomas, and Tabronx pay him a percentage of the loan amount for the falsified information. Once the coins hit their accounts, they started running it up.

They were supposed to be using those PPP funds to pay employees. Instead, they wrote checks out to individuals who weren’t even employees. Sighs….

You can read the full court filing here.

Sounds like what "Love & Hip Hop: Atlanta" star Arkansas Moe - Karlie Redd's ex-fiance - got arrested and charged for.

Right before COVID shut down the U.S., Rare Breed CEO Thomas "Donnie B" Wilson talked about how he launched his independent record label.

"I moved to Atlanta 2008 to Attend Clark Atlanta University, he told Voyage ATL. "In my first year of college, I started my own party promotional team to start throwing college parties and I started to manage my roommate who wanted to be a rapper. I did that for nine years. After that, I decided I wanted to start doing music myself and tell my story. 2017 I made my first song, Called Why Not. Six months later, I dropped my first project titled Rare Breed Vol 1. The project got a lot of good feedback from my supporters. A Few months after I dropped my first project I created a label because I wanted to help out other artist. Jan 14. 2018 I created My Label Rare Breed Nation, LLC. Over the last two years, I have been building the brand and learning the business and developing artists."

"I am the CEO of Rare Breed Nation an independent record label. I’m also an artist. I’ve built a team that consists of engineers, producers, artists, videographers and managers. I’m proud of the movement that I’ve built. I have supporters all over the world. My brand has had national exposer. I have all the pieces to run a very successful business label. What sets me apart from others is exactly what the company says I’m a Rare Breed. I turn dirt into gold."

That last sentence didn't age well.

Six other business owners in Georgia, Ohio, Minnesota and Michigan did something similar and they got caught as well. NewsNation reports:

In June, FBI agents seized funds from three Bank of America accounts held by Bellator Phront Group and Elite Executive Services. The two companies share the same Roswell address, and both have Darrell Thomas as a company officer, according to Georgia Secretary of State’s records.

Darrell Thomas, of Duluth, is one of five small business owners facing federal bank fraud charges in the alleged scheme, which involved five companies based in Georgia, Ohio, Minnesota and Michigan. Each applied for PPP loans of about $800,000, each said they had sixty-something employees, and each reported nearly identical quarterly payroll expenses in 2019, prosecutors allege.

Instead of paying employee wages and business overhead expenses, as Congress intended, most of the loan money was moved between various bank accounts held by the companies, and Thomas used some of the money to buy a Mercedes Benz S Class and a Range Rover, U.S. Attorney BJay Pak has alleged. Another defendant made payments on car loans with her money, while others freely spent their portions on “various personal expenses and withdrawals,” prosecutors say.

Not only did the nearly-identical details in the applications raise red flags, but court filings say investigators also determined that none of the businesses filed payroll tax forms with the IRS in 2019 nor in the first quarter of 2020, and four of the companies submitted applications with fake bank statements showing inflated balances.

This wasn't smart at all.

Oh and get this…

Cross River Bank and Celtic Bank were the top two lenders who approved most of the allegedly fraudulent PPP loans. According to reports, Cross River Bank and Celtic Bank Corporation each processed 15 allegedly fraudulently obtained PPP loans, for a total of 30.

MESS!

As we always say around these parts, play stupid games, win stupid prizes.

Photo: Elise Amendola/Associated Press

source: theybf

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Etiam id libero non erat fermentum varius eget at elit. Suspendisse vel mattis diam. Ut sed dui in lectus hendrerit interdum nec ac neque. Praesent a metus eget augue lacinia accumsan ullamcorper sit amet tellus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Etiam id libero non erat fermentum varius eget at elit. Suspendisse vel mattis diam. Ut sed dui in lectus hendrerit interdum nec ac neque. Praesent a metus eget augue lacinia accumsan ullamcorper sit amet tellus.

0 comments:

Post a Comment